- MTN MoMo has launched Wesotinge Season 2, specializing in MoMo Advance, a service providing on the spot, need-based top-ups to deal with frequent monetary challenges with ease.

- MoMo Advance is accessible to all MTN MoMo customers, offering common eligibility and a seamless one-prompt transaction expertise.

- Alongside MoMo Advance, MTN MoMo provides different monetary merchandise, together with Mokash, MoPESA, MoSente, XtraCash, and financial savings options, selling monetary inclusion and safety.

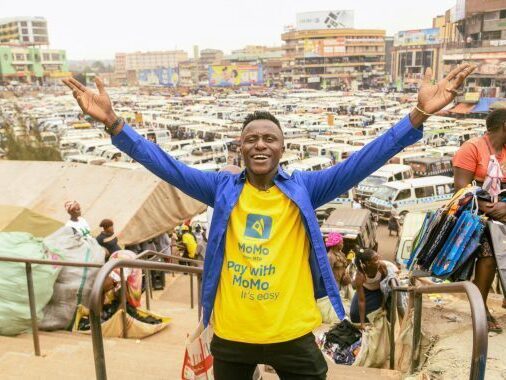

MTN Mobile Money (U) Limited (MTN MoMo) has launched Wesotinge Season 2, aiming to additional empower Ugandans by accessible, quick, and handy monetary companies. Following the success of Season 1, which noticed a major enhance in mortgage uptake, Season 2 focuses on MoMo Advance, an modern overdraft service designed to deal with on a regular basis monetary challenges with unmatched simplicity.

In 2024, Wesotinge Season 1 achieved a major progress in mortgage uptake, introducing thousands and thousands of Ugandans to the probabilities supplied by MTN MoMo Loans and Savings. With over 13.2 million customers, MTN MoMo continues to remodel cellular cash right into a complete monetary ecosystem tailor-made to fulfill the varied wants of its prospects.

Unlike conventional time period loans, MoMo Advance is accessible to all MTN MoMo customers, offering on the spot, need-based top-ups that get rid of failed transactions attributable to inadequate balances. Whether paying payments, sending cash, or shopping for airtime, MoMo Advance ensures you’re by no means caught quick.

“With MoMo Advance, we’ve redefined comfort for our prospects,” mentioned Jemima Kariuki, Chief Product Officer of MTN MoMo. “This service is not only a mortgage; it’s an answer that adapts to your wants in real-time. Whether you are managing on a regular basis bills or tackling sudden conditions, MoMo Advance ensures that cash is all the time inside your attain.”

MoMo Advance provides a seamless and accessible monetary resolution for all MoMo customers. Once activated, prospects can get pleasure from a streamlined consumer expertise with only one immediate throughout transactions, avoiding the complexities typically related to conventional mortgage processes.

Designed to offer precisely what is required, MoMo Advance eliminates pointless debt or wastage. The service is right for on a regular basis situations corresponding to paying utility payments like Yaka, National Water, Pay TV amongst others, sending cash by P2P transactions, making funds on Momo Pay or shopping for airtime and bundles,. By simplifying the monetary journey, MoMo Advance delivers peace of thoughts to each consumer.

While MoMo Advance takes middle stage in Wesotinge Season 2, it’s a part of MTN MoMo’s bigger suite of mortgage and financial savings merchandise, which embrace:

- Mokash (in partnership with NCBA)

- MoPESA (in partnership with KCB)

- MoSente (in partnership with Jumo)

- XtraCash (in partnership with Postbank)

Additionally, MTN MoMo financial savings options allow prospects to begin saving with as little as UGX 500, incomes curiosity on their balances. These options make it simpler to avoid wasting for varsity charges, emergencies, or private targets, providing a easy and rewarding path to monetary safety.

Through interactive activations and focused training campaigns, Wesotinge Season 2 goals to equip each MoMo consumer with the instruments to confidently handle their monetary journey.

“MTN MoMo is on a mission to make monetary safety accessible to all Ugandans,” added Kariuki. “Wesotinge Season 2 underscores this dedication by guaranteeing each buyer has the monetary instruments they want, proper at their fingertips.”

Customers can activate MoMo Advance by dialing *165*5# or accessing the “Loans” characteristic on the MTN MoMo app. For extra info, go to MTN MoMo Advance.